Tax Deduction for Donation of Contents.

Ray Nugent summarizes the certified appraisal service of all tangible assets in and around a home

ValuePros produces IRS qualified, USPAP compliant appraisal reports in order to itemize a tax deduction for the donation of residential contents. Many of our clients that receive a certified donation appraisal report purchased a residence “furnished” and decide not to keep certain items, and often, choose not to keep any of the previous owner’s items. In fact, many new owners remove entire kitchens, bathrooms, and fixtures in order to personalize their new home. Our accredited appraiser’s not only certify the value of the contents: Fine Art, Decorative Art, and Furnishings, we also certify the value of kitchen cabinets, counters, appliances, and bathroom fixtures. All of these existing items in a just-purchased-soon-to-be-remodeled home have value in the secondary resale market and therefore are welcome donations to charitable organizations in order to create revenue for their cause.

CONTACT US for a list of valid charitable organizations that desire donations of contents, fixtures, and appliances

When you are considering the option of a tax deduction for donation of contents, fixtures, and appliances there are some IRS tips for deducting charitable contributions:

- You must be giving to a qualified organization

- Contents must generally be in good used condition or better to be deductible

- If you are donating an item or group of items valued at more than $5,000 you must complete Section B of Form 8283, which requires an appraisal by a qualified appraiser

The appraisal team at ValuePros has been producing IRS qualified appraisal reports for the tax deduction for donation since 1976. If you previously donated the items and were later informed you require a qualified appraisal, we can help! We specialize in certifying the value of assets after they have been donated and no longer are accessible by the donor. CONTACT US to discuss how we can produce the IRS qualified report and signed IRS 8283 form you must have in order to itemize your charitable donation deduction after your items have been donated.

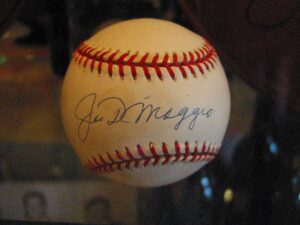

ValuePros has a team of experienced IRS qualified appraisers that certify the value of Fine Art, Decorative Art, Collectibles, Furnishings, Fixtures, and Appliances in a USPAP compliant certified appraisal report. If you are considering benefiting from a tax deduction for donation of contents and other items CONTACT US to discuss your options with experienced professionals that have assisted thousands of taxpayers.